What is crowdlending?

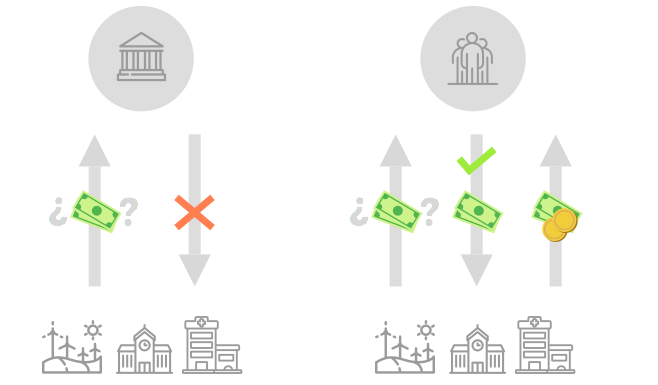

Crowdlending allows companies to finance themselves through a large and diverse group of people (crowd = crowd, lending = lending money), without having to go ta a bank.

In the crowdlending model people lend small amounts of money to a company in exchange for a financial return stipulated in a loan agreement.

"Ecrowd finances investment projects with a more open vision than traditional banks"

With crowdlending, a new financing alternative exists to obtain financing for their investments, with which they can diversify their sources of funds, or the positive marketing campaign from the crowdlending campaign.

On the other hand, private investors benefit from higher returns, know exactly where their money is invested and they decide the use that is given to their money, which in turn generates a positive impact.

Ecrowd MODEL

The Ecrowd platform! is a crowdlending platform, specialized in financing of investment projects, and is leader in this segment in our country. The benefits of the Ecrowd platform consist in connecting companies and investors in a quick, transparent and easy way, providing affordable financing to companies and greater profitability to investors. There are no intermediaries, no banks, and we operate quickly and with total transparency.

Crowdlending with Ecrowd is beneficial for all.