Should I be worried about bad loans ?

Crowdlending vs. bad loans

As we have explained in our post about diversification you should never invest all your wealth in a single investment, in order to minimize the impact of an investment that is going bad. Crowdlending makes this a very easy task, with just a couple of clicks you can lend your money to a variety of projects or companies based on the sector, the type of projects, the geographical location, etc. The low minimum investment, and the low or zero cost, makes it easy to invest in various loans at the same time.

Diversification helps to protect from bad loans

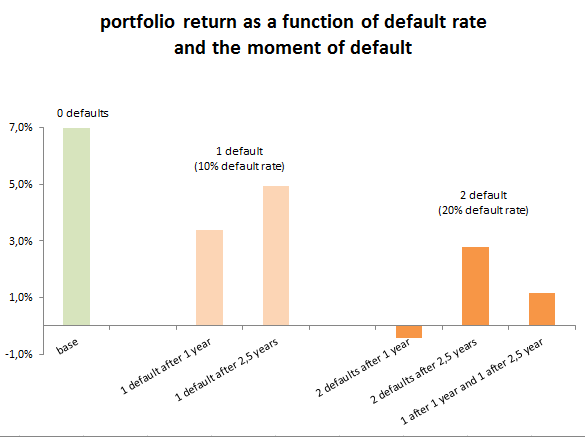

But how does diversification help you to protect from investments that go bad, and how much should you diversify? To answer these questions, lets look at a practical example. Suppose you have invested 5.000 Euros in 10 loans, with a 5 year duration and an 7% annual interest rate. We can then calculate what the effect of a bad loan would be on the combination of loans. We use different scenarios: 1) no bad loans, 2) one bad loan, which means a 10% default rate, 3) 2 bad loans, which means a 20% default rate. Another important factor to take into account is the moment the loan goes bad. Since most of the loans at ECrowd start paying back your invested capital from the first month, every month that passes the invested amount reduces (which you can re-invest in other investments). The later the loans goes bad, the less the impact on the portfolio. Below graph shows the final return of your portfolio, in the different scenarios.  As you can see, the final effect of the bad loan depends on the number of defaults and when the default occurs. The earlier the default occurs, the bigger the effect on your final return. Fortunately, most defaults occur later on, and very rarely the first year. Only with an excessive 20% default rate, after the first year of the loan, your return may get negative.

As you can see, the final effect of the bad loan depends on the number of defaults and when the default occurs. The earlier the default occurs, the bigger the effect on your final return. Fortunately, most defaults occur later on, and very rarely the first year. Only with an excessive 20% default rate, after the first year of the loan, your return may get negative.

What are typical default rates?

Default rates are normally based on historical performance. So let’s look at platforms similar to Ecrowd!, but with a longer operating history. UK has the longest history in Europe regarding business crowdlending and if we look for example at Funding Circle, the UK’s biggest business crowdlending site, the default rate of current loans is 1,4% (https://www.fundingcircle.com/statistics). And over the total lifetime of a loan, they expect a default rate of 1,2% for less risky loans, up to 10,4% for the high-risk loans. Another interesting default rate comes from the UK P2P finance association. They have aggregated numbers from all their members and over 2013, they had an aggregate 0,9% bad debt rate (amount of bad loans over the full loan lifetime / yearly loan volume), but they work with an estimated 4,7% (including riskier loans).

Should I be worried about defaults?

Defaults are always one of the biggest concerns when people are considering investing in crowdlending. Of course, you should take these into account and accept it will happen one day, but as you can see in the above graph if you are properly diversified, then the effects are marginal. If your current crowdlending platform, like Ecrowd!, does not offer you sufficient opportunities to invest to diversify, you can always try with the other platforms, like Arboribus, Loanbook, or Crowd2B.

The ECrowd! team

——-

Annex:

En el siguiente ejemplo te mostramos el impacto de la morosidad suponiendo que has invertido 1.000 euros distribuidos en 20 préstamos de 50 euros a 4 años y al 10% de Tasa de Interés Nominal Anual. Como puedes observar, aún en el caso de tener uno o dos préstamos morosos (que sería una morosidad importante de entre el 5 y el 10%) podrías seguir teniendo una rentabilidad positiva.

TIN: * Tasa de interés nominal anual con pagos mensuales según tabla de amortización francesa.

En la práctica recomendamos no invertir más del 5% de tu inversión total en un mismo préstamo. Además, puesto que las diferencias en los tipos de interés no son muy significativas, hay pocos incentivos para concentrar tus inversiones en pocos préstamos y asumir más riesgo. De esta forma podrás minimizar las consecuencias de un impago en alguno de tus préstamos y aumentar las probabilidades de obtener una rentabilidad atractiva el conjunto de tus préstamos. ¿Y si sólo hay dos o tres solicitudes de préstamo? Progresivamente se publican nuevas solicitudes y tendrás la oportunidad de ir incrementando el volumen de capital prestado a través de la plataforma. Por ejemplo, si te planteas llegar a invertir 2.000 euros puedes empezar invirtiendo 100 en cada préstamo (300 euros en total) y esperar a próximas solicitudes para invertir el resto. Y recuerda que eres tú quien decide: si tienes dudas acerca de dónde y cuánto invertir te recomendamos que consultes a tu asesor financiero.

Escrito por Carles Escolano, co-fundador de Arboribus

Tags: crowdlending, loans Previous post:

« ¿Por qué y cómo diversificar tus inversiones?

Next post:

Crowdfunding or crowdlending, which one is for me? »