Impact investing: making an impact is easier than you think.

Definition of Impact Investing

Impact Investing is investing with the intention to generate a positive social impact beyond financial results. The term impact investing emerged in 2007, after more and more investors started to take into account intangible benefits in their investment decisions. According the latest report on impact investing by Rockefeller foundation and J.P. Morgan the market is still in its infancy, with the focus on marketplace building with pioneering initiatives like Mosaic, Abundance Generation and ECrowd!.

The growing interest in Impact Investing

Although Impact Investing is not a new practice, there are factors that have converged in recent years to generate new interest.

First of all the crisis of 2008 has caused investors to think more broadly regarding their investment decisions. Second, the widespread use of e-commerce and the emergence of lending between private persons (P2P lending) have demonstrated that internet can also be used for financial intermediation.

This reduces the cost of intermediation, which makes these investments more attractive, and makes these investments available to a larger public, mainly small and medium investors.

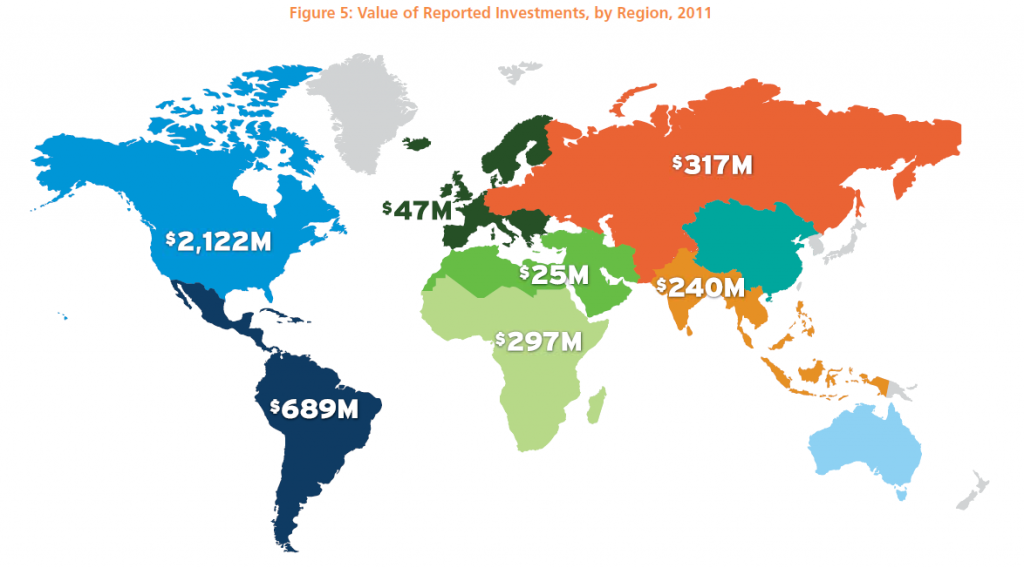

All these factors have led to a considerable growth of Impact Investing in the last four years. In 2011 total estimated investments grew by 100% to 4,4 billion dollars, and is predicted to accelerate its growth.

Is crowdfunding an impact investment?

Impact investing through P2B platforms is different from crowdfunding sites like Indiegogo or Kickstarter. In these platforms people contribute to projects without any expectations to receive the contribution back.

With P2B impact investing platforms, contributions are normally investments through debt or equity instruments. Contribution per person normally exceeds €1,000, with longer-than-traditional payback times, and sometimes a non-existing «exit strategy». Lastly, although some of these investments are for nonprofits, impact investing typically involves for-profit, social or environmental driven businesses.

What are the various types of Impact Investing?

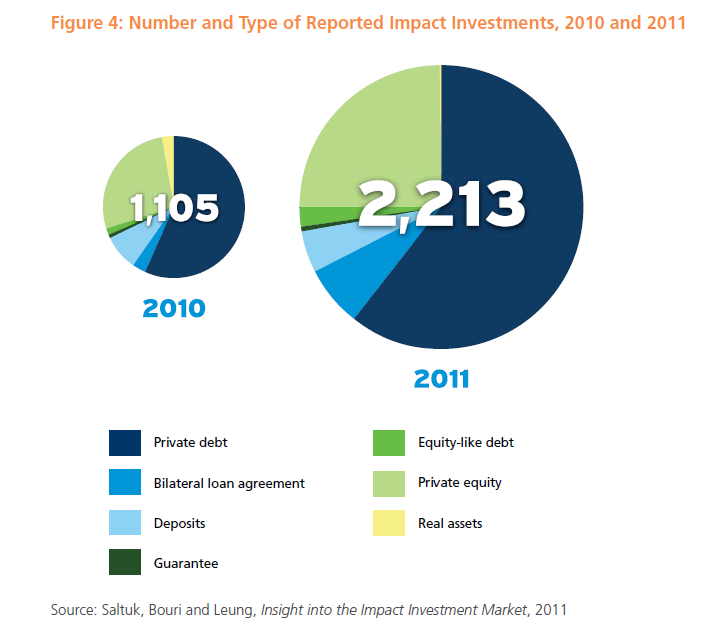

As shown in the above graph, approx. 75% of all impact investments worldwide were made through debt, which offers a relatively safe investment. Good examples of these are green bonds, solar bonds, and microfinance bonds—all innovative products that have attracted significant amounts of private and public capital. At the same time, new online products, including crowd-sourced financing models, have also appeared.

Below you can see the amount of impact investment as a function of regions of the world. You can see that North America is by far the region where the most money is put in Impact Investing.

Much remains to be done. The development of an effective global industry is a long-term, complex and difficult task. However, the industry succesfully moved from «uncoordinated innovation» to a more sustained «marketplace-building» phase, and is poised to enter an «acceleration and execution» phase.

What about you? Will you reconsider your investments ? Making an impact is easier than you think.

Tags: crowdfunding, impact investment Previous post:

« Crowdlending – Democratizing financial services

[…] You can generate huge impact through crowdlending. Instead of putting your money in a fund or some of the investment products offered by the banks, you can lend it directly to a project or company you believe in. We wrote an earlier article about impact investing. […]